Welcome to CloudDesk GST

Introducing India's First Cloud-based GST ITC Reconciliation Tool Fueled with IMS

About Us

Clouddesk GST is a technology company. We are in the business of designing and developing best GST Reconciliation software and technical tools which are user friendly. At Clouddesk, we provide cloud-based software solutions to help businesses and tax professionals to make the compliance of Goods and Services Tax, smooth, simple and accurate. Our mission is to save money and time for the subscribers with the help of our flawless software tools.

Why Subscribe Us?

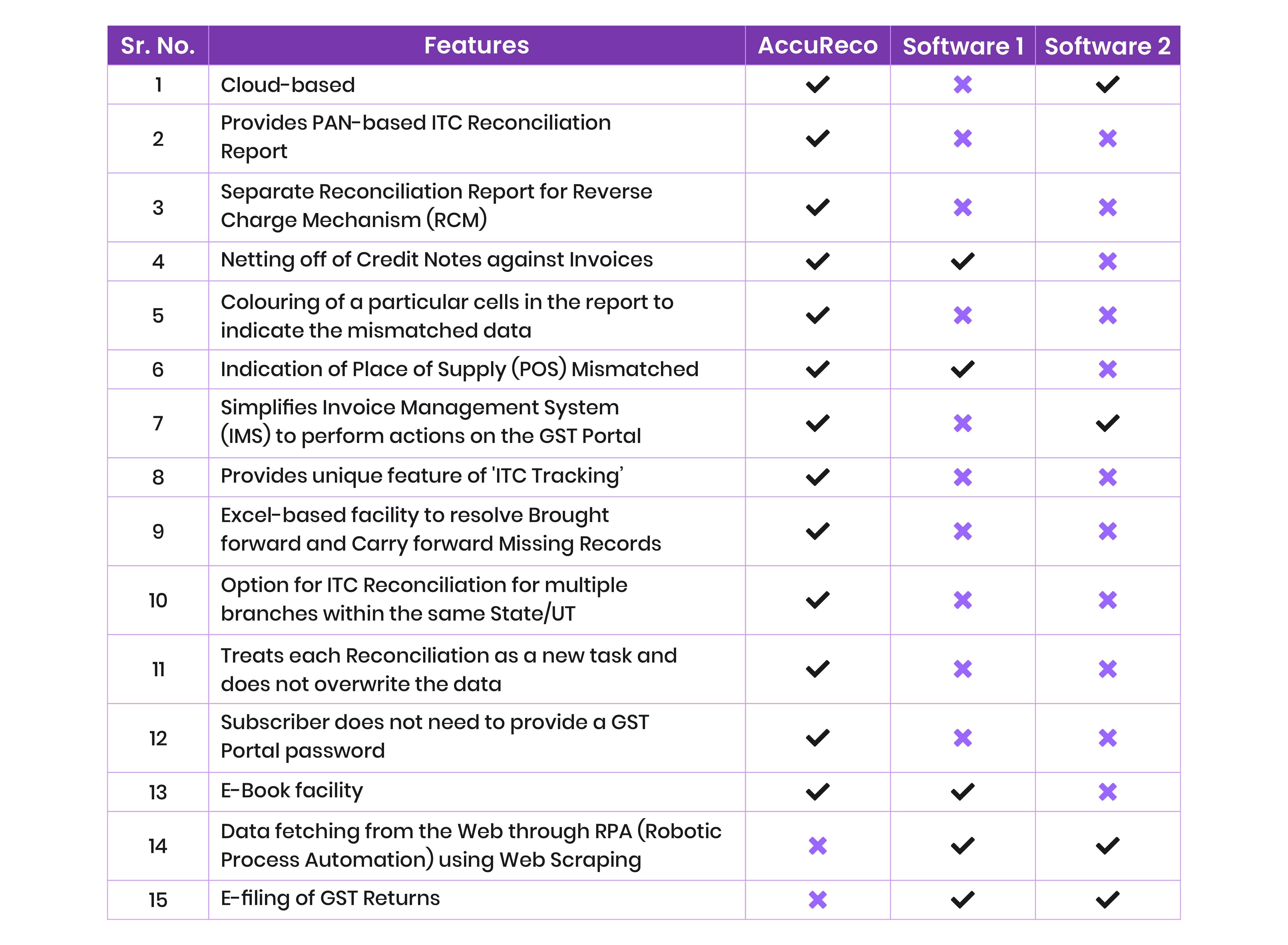

Our users love the superfast AccuReco experience, a cloud-based GST ITC Reconciliation Tool, which saves their time and money while increasing productivity by simplifying the lengthy and tedious task of GST ITC Reconciliation and a broad comparison of AccuReco with other software, as highlighted to the left, showcases its uniquely designed features, which undoubtedly deserve your attention.

Exciting Stats for You!

Reconciliations Performed

Records Processed

GST ITC Secured

Human Hours Saved

Exclusive Offer for Practicing Chartered Accountants

on our Cloud-based GST Software!

Avail this benefit as per the ICAI arrangement

Happy Customers

Customer satisfaction is our major goal. See what our customers are saying about us

AccuReco is a simple and user friendly cloud based Reconciliation software for all types of businesses and tax professionals. Its mapping feature is really amazing as it allows the user to upload data from any accounting package.

AccuReco is the best ITC Reconciliation tool we have used, which help us to track the eligible ITC and provides a superfast Reconciliation report for a huge number of transactions of our business. We would definitely recommend AccuReco to businessmen and professionals.

Committed to Security

SSL Secure

Your data is transmitted across SSL-certified pathway

Encryption

Ensured that your data is stored in an encrypted framework

AWS Server

Robust, secure and lightning-fast server with encrypted MySQL database

GSP

Seamless GSP integration with a secure OTP-based solution

Annual Plan

- Customised GSTINs

- Customised Device Login

- Customized Records

- Call Center Support

*Annual records are divided by 12 to calculate monthly allocations

Exclusive Offers for Practicing CAs

For Chartered Accountants

Annual Plan

- 50 Clients

- 500 Recos / Client

- Single Device Login

- 24000 Records* / GSTIN

- Call Center Support

*Valid for a period of 2 years

Annual Plan

- 50 Clients

- 1000 Recos / Client

- Single Device Login

- 24000 Records* / GSTIN

- Call Center Support

Annual Plan

- 100 Clients

- 2000 Recos / Client

- Double Device Login

- 24000 Records* / GSTIN

- Call Center Support

*Annual records are divided by 12 to calculate monthly allocations

Yes, one or more GSTINs can be added to the existing subscription module. However, the same can not be reduced once upgraded

No, only annual subscriptions are available

Yes, you can add more devices in your existing subscription by paying nominal charges per additional device

Yes, we have topup subscription plans. Please contact our Sales Team for further information

Earlier ITC Reconciliation tasks in my office were tedious and time consuming. But after introducing AccuReco, the ITC Reconciliation process has become error less, super fast and easy.