Snowlake is a multi-concept and powerful site template contains rich layouts with possibility of unlimited combinations & beautiful elements.

Learn More

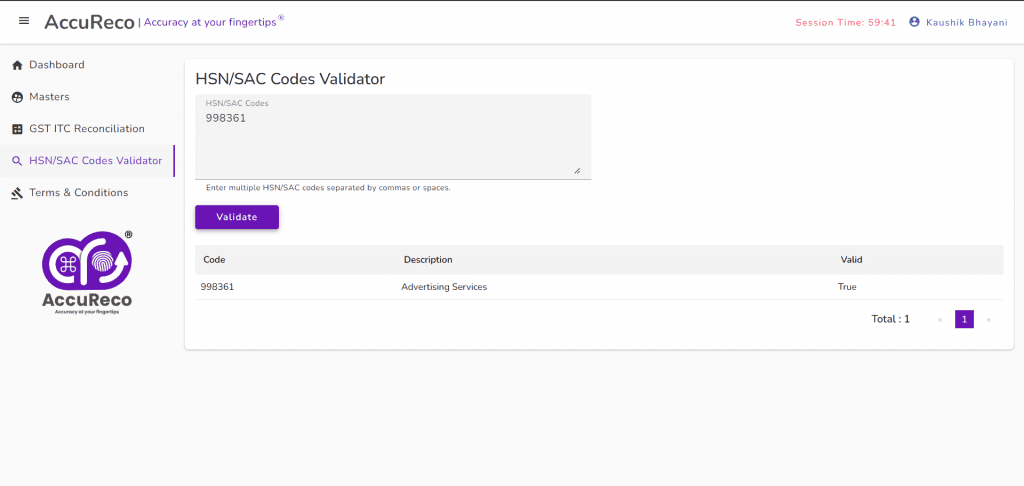

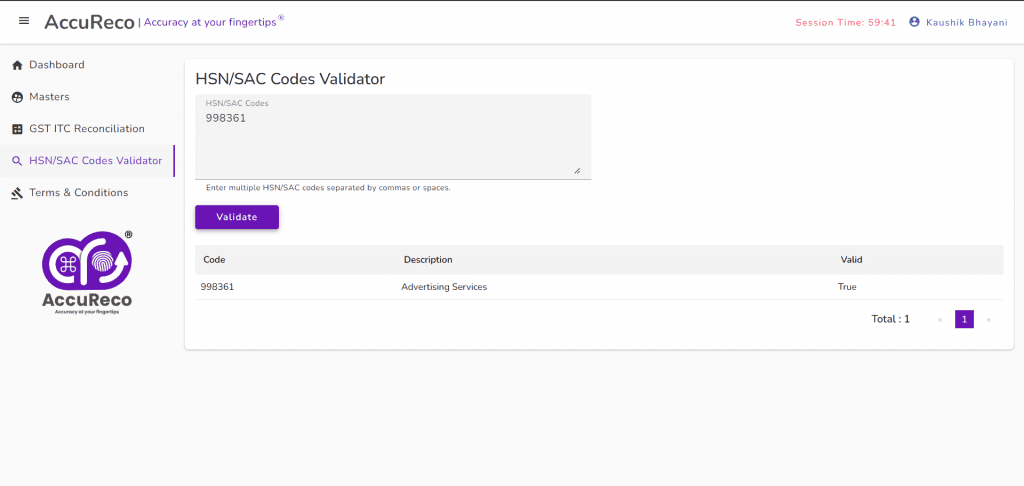

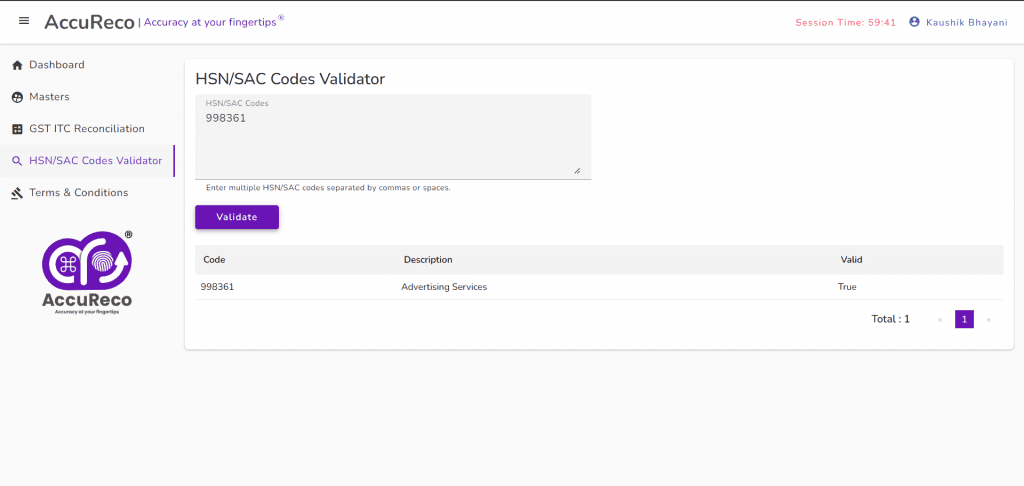

HSN Bulk Verification:

HSN Bulk Verification: Streamline Your Product Classification Process

Are you looking to simplify your product classification process for GST compliance? HSN bulk verification could be the solution you need. This comprehensive guide will walk you through everything you need to know about HSN bulk verification and how it can revolutionize your tax management process.

What is HSN Bulk Verification?

HSN bulk verification is a process that allows businesses to validate and verify Harmonized System of Nomenclature (HSN) codes for multiple products simultaneously. This efficient method ensures accurate product classification for GST purposes, saving time and reducing errors.

Why Use HSN Bulk Verification?

Implementing HSN bulk verification offers numerous advantages:

- Time-saving: Verify multiple HSN codes at once

- Accuracy: Reduce errors in product classification

- Compliance: Ensure adherence to GST regulations

- Efficiency: Streamline your tax filing process

- Cost-effective: Minimize resources needed for manual verification

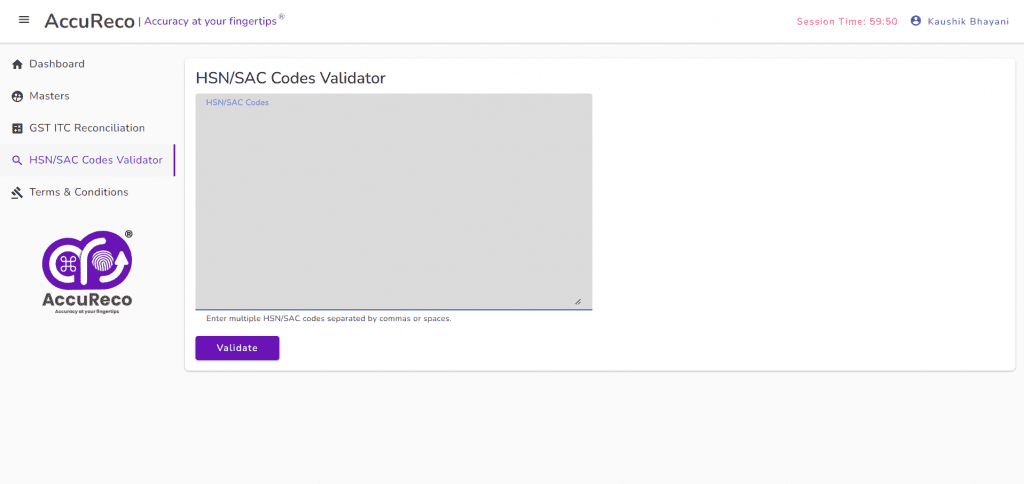

Key Features of HSN Bulk Verification Tools

Most HSN bulk verification tools come equipped with the following features:

- Bulk upload capabilities for product data

- Automated HSN code matching and verification.

- Error identification and reporting.

- Integration with GST filing platforms.

- Historical data management and reporting.

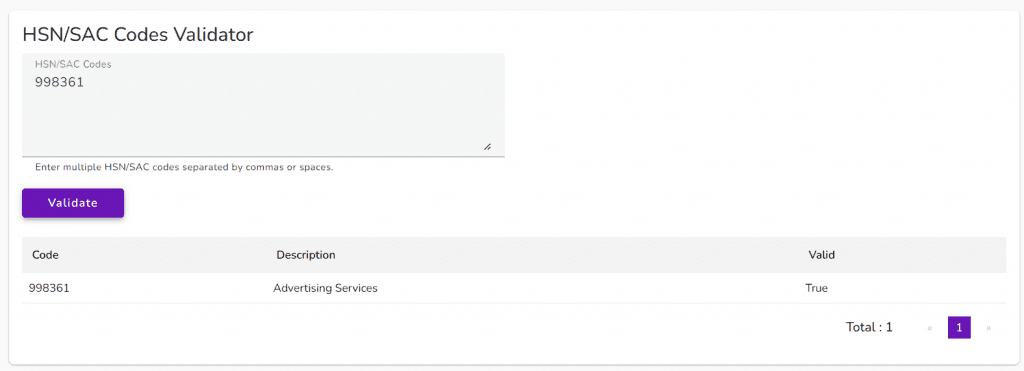

How HSN Bulk Verification Works

The typical workflow of HSN bulk verification includes:

- Preparing a spreadsheet with product details.

- Uploading the spreadsheet to the verification tool.

- Automated matching of products with HSN codes.

- Identifying mismatches or unclassified products.

- Generating verification reports.

Benefits of Regular HSN Bulk Verification

Incorporating HSN bulk verification into your routine offers several advantages:

- Improved accuracy in GST returns.

- Reduced risk of penalties due to misclassification.

- Enhanced inventory management.

- Better financial planning and forecasting.

- Simplified product onboarding process.

Choosing the Right HSN Bulk Verification Tool

When selecting an HSN bulk verification tool, consider factors such as:

- User-friendly interface.

- Accuracy of HSN code matching.

- Integration capabilities with your existing systems.

- Scalability to handle growing product catalogs.

- Regular updates to HSN code database.

Best Practices for HSN Bulk Verification

To make the most of your HSN bulk verification process:

- Regularly update your product database.

- Conduct periodic bulk verifications.

- Keep detailed records of verification results.

- Stay informed about HSN code changes.

- Train your team on proper product classification.

Common Challenges in HSN Bulk Verification

Be prepared to address these common issues:

- Ambiguous product descriptions.

- Products falling under multiple HSN categories.

- New or unique products without clear classifications.

- Keeping up with HSN code updates.

- Reconciling discrepancies in existing classifications.

Integrating HSN Bulk Verification with Your Business Systems

For seamless operations, consider integrating your HSN bulk verification process with:

- Inventory management systems

- E-commerce platforms

- Accounting software

- GST filing tools

The Future of HSN Bulk Verification

As technology evolves, expect to see advancements in HSN bulk verification, including:

- AI-powered product classification

- Real-time verification capabilities

- Enhanced data analytics for tax planning

- Blockchain integration for secure product data management

Legal Considerations and Compliance

While using HSN bulk verification:

- Ensure compliance with local GST laws

- Stay updated on changes in HSN classifications

- Maintain digital records as per legal requirements

- Use the tool as an aid, not a replacement for professional judgment

Impact on Different Industries

HSN bulk verification is particularly beneficial for:

- E-commerce businesses with large product catalogues

- Manufacturing companies with diverse product lines

- Import-export businesses dealing with various goods

- Retail chains with multiple product categories

Conclusion

HSN bulk verification is an invaluable tool for businesses navigating the complexities of GST compliance. By automating the classification process, ensuring accuracy, and saving time, it allows you to focus on strategic business operations. Embrace the power of HSN bulk verification today and experience a new level of efficiency in your product management and tax processes!